Cost price, along with market information, is a crucial factor in pricing decisions. The significance of cost price in decision-making varies for different types of organizations (e.g. manufacturing, service, sales), and the required cost calculation method also differs based on the organization’s activities. This article provides a brief overview of the activity-based costing method used by Optime in several implementation projects.

The Problem

The modern business environment is characterized by intense competition, shrinking margins, and rapid changes. In such a scenario, a company’s ability to predict and evaluate various scenarios of its operations and choose the best option is crucial. The cost price of products and resource needs are essential factors, even in optimistic sales projections, as it is important to understand if the forecasted volumes can be achieved. This can only be achieved through an activity-based costing system that accurately assigns costs, provides a correct cost price, and can model future cost and resource use.

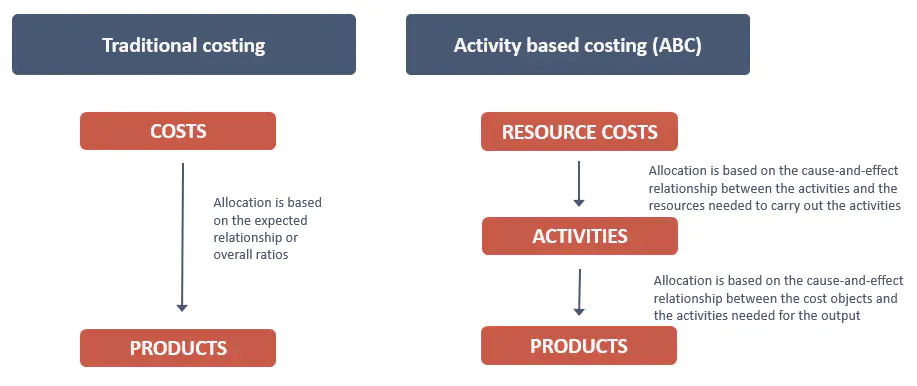

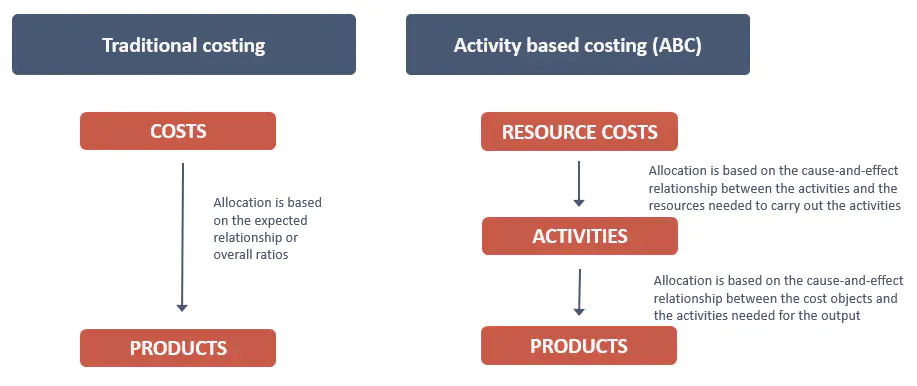

Traditional costing methods have several drawbacks, such as:

- Lack of causality between inputs and outputs

- Inaccurately determining product/service level costs;

- Distorting results in favor of small-scale or non-standard products;

- Not providing feedback to management for controlling and managing operations;

- Not providing information on resource utilization and the reasons behind costs.

- Not suitable for forecasting due to its inability to handle significant changes in business volumes and product structure.

These problems arise because traditional costing is based on accounting, which focuses on control rather than management and reflects past events.

Objective of the cost accounting

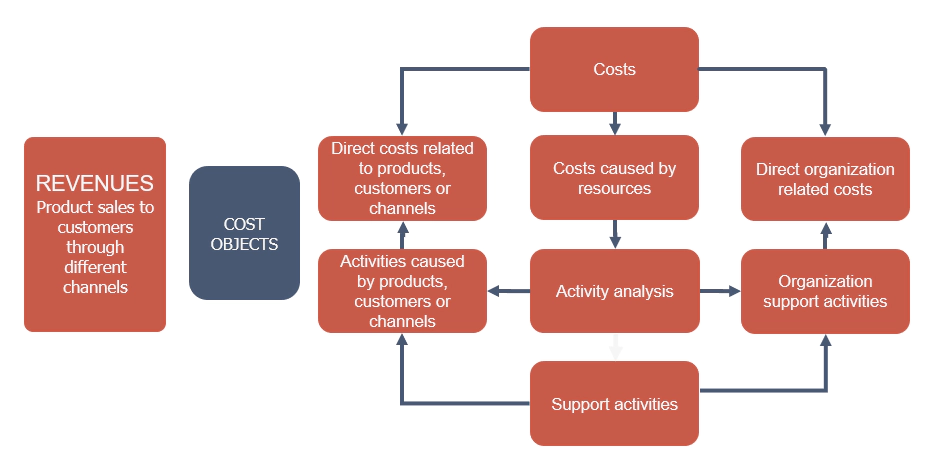

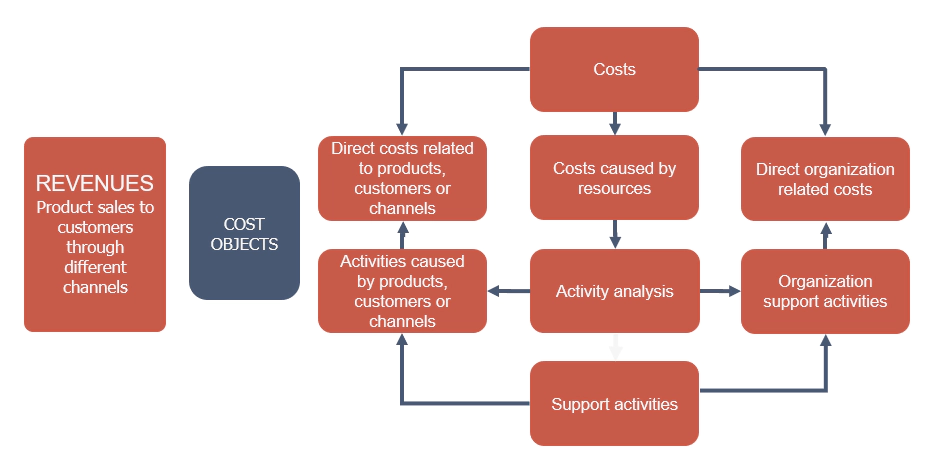

Looking at the costs of the organization as a whole, their distribution can be viewed as shown in the figure

Costs in an organization can be broadly divided into direct costs related to outputs (cost objects) and non-specific costs. Direct costs can be further divided into costs related to outputs (services, products, and customers), costs related to the operation of the organization, and support costs that support the resources carrying out other activities. The ABC (activity-based costing) theory links support activities directly to primary activities. However, linking support activities to resources is more logical as it reflects the cause-and-effect relationship between the resources and the sales process. The ABC method is more valuable when the proportion of direct costs is smaller and activities play a more important role. The goal of cost accounting and the cost model should be to reflect the whole company, provide a causal and understandable cost price, and have sufficient detail and accuracy for forecasting. Excessive perfection should be avoided in the implementation of ABC, as it can make the project too complicated.

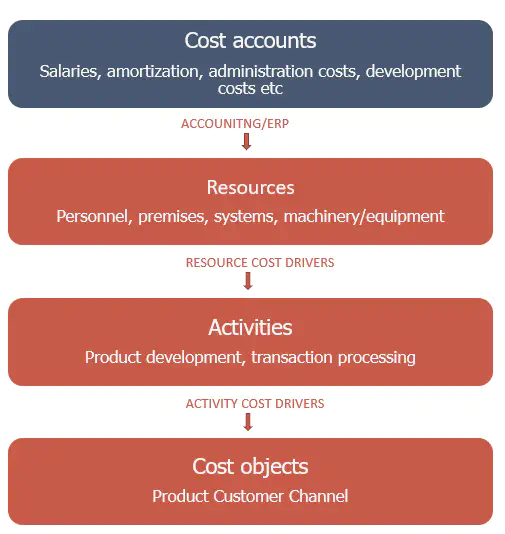

Organizing cost accounting

So, how do we achieve these objectives? Traditional approaches to implementing activity-based costing models often begin with mapping activities, i.e. analyzing processes, which makes the implementation challenging, time-consuming, and prone to errors. An alternative approach is to focus on analyzing and organizing the inputs and outputs of the company and building a cost model based on them. This makes the implementation process easier, while still ensuring the accuracy of the model.

Cost objects

To build a cost model, we start by focusing on outputs, or cost objects, which are products/services that lead to costs and create value for customers. The cost object structure is based on revenue and may include products/services, customers, and channels. To make the list of cost objects simple, we start with the price list and include any services provided for free. It is best to group the list and later describe the activities to help find procedural similarities. Customer groups are described rather than modeling individual customer costs. To complete the cost object list, it is necessary to gather information on revenue, which can be challenging in larger organizations due to a lack of communication between information systems.

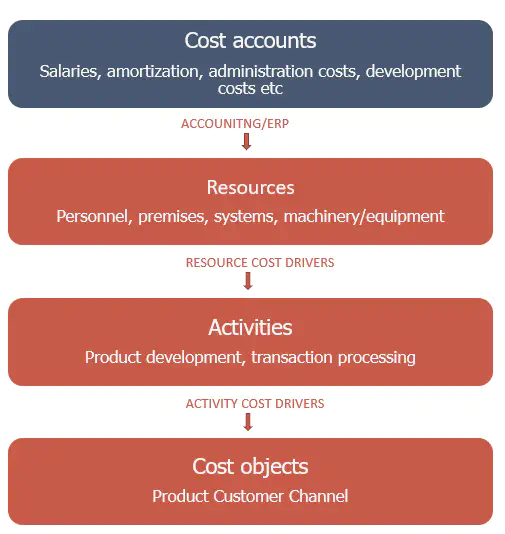

Resources

In order to build the cost model, it is important to distinguish between accounting costs (types of expenses) and resources. Types of expenses form the basis for organizing accounting reporting (income statement), while resources are objects (people, equipment, systems, premises) that participate in activities. To compile the list of resources, we can start by looking at information about physical inventory, personnel, and materials used in production. In addition to real resources, we need to describe other direct-cost-type inputs such as costs associated with product groups or customer groups.

To ensure effective cost accounting, it is necessary to have a defined logic for using accounts and resources and information about the type of expense and related resource for each cost line. This can be achieved by using organized lists, which can be summed up by account, resource, or unit. Additionally, it is important to describe the resource at the moment the expense is incurred to avoid difficulty in later identification. Most accounting software supports the use of three dimensions (account, unit, cost object) in recording expenses without requiring additional investments or increasing workload.

Having defined cost objects and organized inputs, we have established the foundation for building a cost model.

Activities (processes)

When explaining processes, the objective is to provide a basic understanding of their connection to resources used, not to give a detailed examination. When building a cost model, the focus is on ensuring a clear link between outputs (cost objects) and inputs (resources), not on in-depth process description like in a quality system.

To accomplish this, processes must be identified at a level that demonstrates a significant relationship between outputs and inputs. Most processes can be logically derived:

If there is an output such as a product/service, customer management, etc., there must also be a process in the organization that creates it, or if it is outsourced, a direct cost is associated with the output.

Additionally, include processes related to organizational management and support activities, found in statutes, job descriptions, etc. This creates a comprehensive list of processes. Starting with process analysis does not result in a better company model as accuracy increases complexity and required resources, lowering the chance of success.

Once the model is complete and has been used, problematic processes can be studied in more detail.

When identifying processes from outputs, the cost behavior must also be analyzed and, if necessary, processes with different cost behaviors must be differentiated. For example:

In banking, deposits/loans can have two distinct activities in the product life cycle - opening and managing the product. These are different in nature and should each be linked to resources using separate activities.

In batch production, activities can be split into two areas - batch-related activities (preparation, completion, etc.) and activities related to producing each unit. These use resources through different relationships and can be distinguished through analysis and observation.

Similarly, the same approach can be used for any company.

Building the model

Once the lists of cost objects, resources, and activities are created, you can start building the cost model. A good approach is to ask each unit head to provide a table that describes the resources available to them, the activities they perform, and the outputs they produce, and the unit head should define the links between them. Each unit head should have some of the information needed, but it may come in different forms, so it must be generalized and linked to the overall model.

In Activity-Based Costing (ABC), there are two approaches: pull and push. The Pull approach involves tracing all resources used to produce a cost object. The Push approach, similar to traditional costing, involves allocating resource costs to cost objects. However, the Push model is not suitable for planning.

For the Pull model, the cost drivers used may not be accurately measured at first. To make the model closer to reality, it is best to refine it gradually, starting from the top-down. First, assess if the resources match the actual output volume, meaning the actual output should be achievable with the company’s resources. It is easier to verify the resource utilization than the accuracy of each driver used. Refine the model until a reliable result is achieved. The need for materials is usually not an issue because the information on direct material costs is readily available.

Pricing

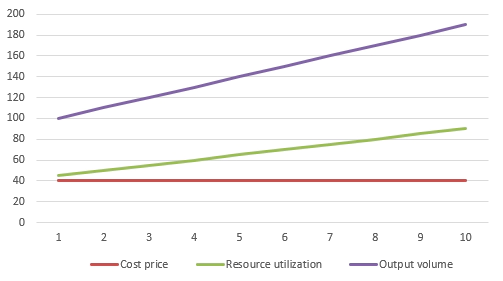

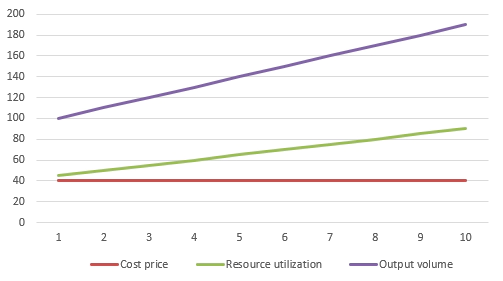

The ABC (Pull) model provides information about two key metrics: cost price and resource utilization. It is important to understand how these are affected and used. Not all questions can be answered by the revenue center’s income statement or cost price. Cost accounting mainly helps in understanding the optimal combination of sales volume, cost price, and resource utilization for pricing purposes.

For example, in non-batch production where the only resource is a production line, the correlation looks like this:

The figure shows that when the volume changes, the product cost price remains constant (but changes in traditional costing as all costs are allocated to manufactured products), but the resource utilization changes. Hence, to maintain profitability, it is necessary to ensure adequate sales volume, but cost price is not a suitable tool to control sales volume as it creates a vicious circle: decreasing sales lead to increasing cost price, which leads to increasing selling price, leading to further decrease in sales.

Summary

For successful implementation of ABC, clear support from top management and a competent core team are necessary.

The core team should consist of 2-3 individuals who can address any problems that arise, with one being the executive sponsor.

In the initial stage, it is important to not focus too much on details and instead establish accounting policies and procedures for revenue and expenses.

The goals of using ABC in private companies is to measure product/customer profitability and plan resource usage, while in government organizations the goal is to ensure efficient and transparent resource utilization. ABC implementation is a learning process where understanding gradually improves and knowledge is used in planning and shaping product structure and customer relationships.