Cost objects are a crucial component in activity-based costing (ABC) for measuring profitability and making informed decisions. They are defined based on the purpose of decision support and are structured to largely correspond to the complexity of a company’s revenue stream. Typically, cost objects include products/services and customers, but additional items like channels may be included depending on the field of activity. The number and structure of cost objects can vary from organization to organization.

In ABC, cost objects represent an object to which costs are allocated using a cause-and-effect relationship. They are divided into two categories: external activities that create added value and internal activities within the organization. This allows for a clear understanding of profitability and the basis for making informed decisions.

Customer value creating part of the organization

Conventionally, externally facing activities aim to sell products and services to customers. This involves two main areas: sales and marketing. Sales focus on building and maintaining customer relationships and executing sales transactions, while marketing is responsible for developing and introducing products/brands. From a profitability standpoint, sales determine customer profitability, and marketing determines product/brand profitability. The method for evaluating this more accurately will be discussed at the end of the article.

Sales

Let’s dive deeper into sales. By its nature, sales is a straightforward process. Although selling may not be easy, the cost behavior in sales has a simple structure. The sales process can be divided into two parts: activities related to customers (such as finding new customers and managing existing ones) and specific sales transactions (selling a product or service to a customer). Our goal is to identify cost objects, which should then serve as the endpoints for cost allocation while maintaining a cause-and-effect logic in cost distribution and profitability assessment. It’s easy to understand that there should be different cost objects for the two distinct areas of sales activities. In the case of specific sales transactions, the main cost object is the product (its cost price) and the transaction channel cost object. In the process of finding and managing customers, the product cannot be used as a cost object as it is irrelevant. Customer management, which is not tied to a specific sales activity, can make up a large portion of the sales team’s activities and linking related costs to specific products lacks a cause-and-effect relationship. Thus, sales results in at least two types of cost objects: the product (cost price) and the customer.

Marketing

Marketing activities, including product development, are centered on products. However, they are not always tied to a specific product, but instead to a product group, such as those under a brand. The challenge in determining the cost object for marketing expenses is whether they should be included in the product’s cost price. I believe that the cost price and marketing-development cost objects should be separated to provide better decision support. Consolidating all costs under the cost price cost object hinders our understanding of customer profitability. Thus, marketing has two cost objects: product (development-marketing) and, if necessary, product group/brand, which is a grouping of specific products.

Internal activities of the organization

In addition to customer-focused activities, organizations have internal operations known as overhead costs. These can be divided into two categories: administrative tasks and development activities (for the organization itself, not for products/customer relations). It’s not appropriate to allocate these costs to existing cost objects such as products, customers, or channels because they have no causal relationship. The goal is to have an accurate understanding of profitability, not to artificially change the cost price. To make informed decisions, it’s important to distinguish overhead costs from value-creating costs and to manage them with one cost object per organization.

Unallocated costs

The previous discussion focused on cost objects used for cost allocation, but using the ‘pull’ method in our cost model may result in unallocated costs. To compare with conventional financial accounting (income statement), these costs should also be included in profitability analysis and accounted for under a pseudo-cost object - unused resources. Thus, we have four types of expenses:

- Product (cost price) and Product (development-marketing)

- Customer

- Organization

- Unallocated resources

Profitability

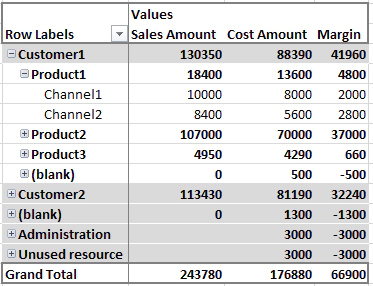

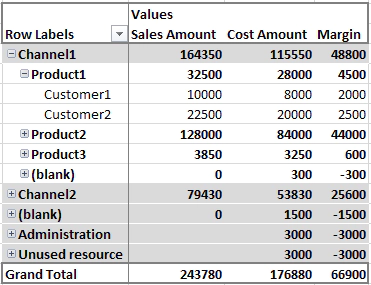

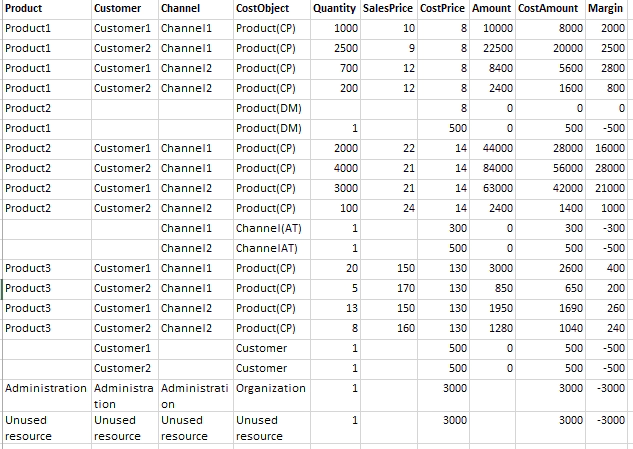

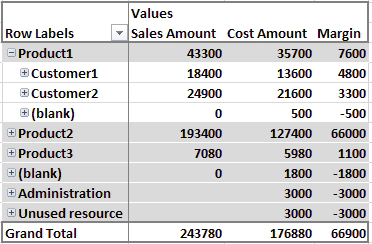

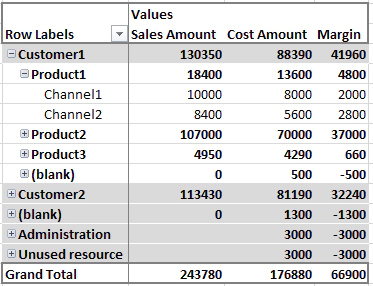

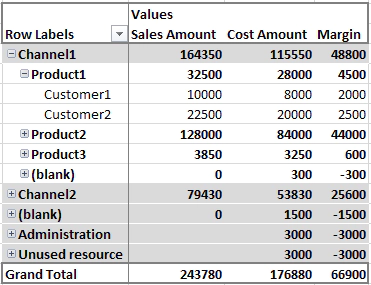

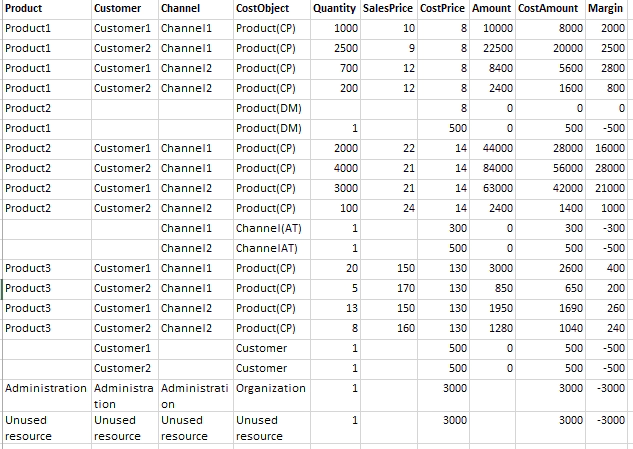

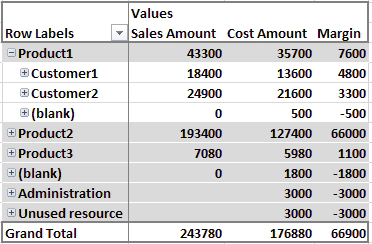

In this example, we will examine how to use the different cost objects to analyze profitability with three products, two customers and two channels. The scenario is straightforward, where both customers purchase all three products through both channels and our objective is to evaluate the profitability of the products, customers, and channels. The resulting data for the profitability analysis could look like this:

Product profitablity

In the product profitability view, we sum the income from the products sold to customers, from which we subtract the cost of the products using the cost price (product / cost price cost object), as a result of which we get the so-called gross profitability of the product. By subtracting from it the costs incurred for marketing and developing the product (Product/development-marketing cost object, in the figure Product1-(blank)), we obtain the net profitability of the product. The need for separation between cost price and development-marketing cost objects should also be understandable here, because the costs of development-marketing are very volatile in nature and often the position of their justification requires more accurate analysis and revision, which, however, does not affect the so-called production cost price of the product

In the product profitability view, we sum the income from the products sold to customers, from which we subtract the cost of the products using the cost price (product / cost price cost object), as a result of which we get the so-called gross profitability of the product. By subtracting from it the costs incurred for marketing and developing the product (Product/development-marketing cost object, in the figure Product1-(blank)), we obtain the net profitability of the product. The need for separation between cost price and development-marketing cost objects should also be understandable here, because the costs of development-marketing are very volatile in nature and often the position of their justification requires more accurate analysis and revision, which, however, does not affect the so-called production cost price of the product

Customer profitablity

In the view of customer profitability, we sum the income from the products sold to customers, from which we subtract the cost of products at cost price (product / cost price cost object), as a result of which we get the so-called gross profitability of the customer. Subtracting from it the costs incurred to manage the customer (Customer cost object, in the figure Customer1-(blank)), we obtain the net profitability of the product.

Channel profitablity

Similarly to product and customer profitability, we can estimate channel profitability.

With all views of profitability, it is important to understand that

Net profit from products ≠ net profit of customers ≠ net profit from channels,

Because different views aggregate costs through different cost objects, using a cause-and-effect relationship specific to a particular view when costs are incurred. At the same time, this approach ensures that we achieve our main goal, i.e. support for purchases (with which we price products to customers (if necessary, in different channels), understanding the incurrence of costs and opportunities to increase efficiency (reducing the cost of unused resources).

In the product profitability view, we sum the income from the products sold to customers, from which we subtract the cost of the products using the cost price (product / cost price cost object), as a result of which we get the so-called gross profitability of the product. By subtracting from it the costs incurred for marketing and developing the product (Product/development-marketing cost object, in the figure Product1-(blank)), we obtain the net profitability of the product. The need for separation between cost price and development-marketing cost objects should also be understandable here, because the costs of development-marketing are very volatile in nature and often the position of their justification requires more accurate analysis and revision, which, however, does not affect the so-called production cost price of the product

In the product profitability view, we sum the income from the products sold to customers, from which we subtract the cost of the products using the cost price (product / cost price cost object), as a result of which we get the so-called gross profitability of the product. By subtracting from it the costs incurred for marketing and developing the product (Product/development-marketing cost object, in the figure Product1-(blank)), we obtain the net profitability of the product. The need for separation between cost price and development-marketing cost objects should also be understandable here, because the costs of development-marketing are very volatile in nature and often the position of their justification requires more accurate analysis and revision, which, however, does not affect the so-called production cost price of the product